A property valuation is an inspection which help determine the current market value of a property. Buyers always request a property valuation if they are considering purchasing a property, in addition to structural surveys that assess its physical condition.

Before providing a mortgage, a bank may request for a valuation to ensure the loan can be covered by the value of the property. This is gives them with the confidence to lend the capital, knowing that if the mortgage goes unpaid, they can recover outstanding amount by re-selling the property.

The valuation provided by an estate agent and that provided by a licensed valuer may be different. This is because estate agents are working for the seller, and receive commission based on the price that the property is sold at. They may be more optimistic in their estimation of the property’s worth than a licensed valuer who is legally responsible for the information provided by them. So, the valuation should be based on facts and accurate up-to-date data. It is important that sellers ensure the property is in as clean condition as possible prior to the valuation, as this can have an impact, as can the state and style of decorations, furnishings, and so on.

A property valuation is typically produced as a report and, in addition to photographs and plans, may contain the following information:

- Age of the property.

- A brief description of the construction.

- Size of the land / building.

- Rooms layout and measurements

- Details of fixtures / fittings.

- Physical condition, wear and tear, etc.

- Details of any issues that need addressing.

- Any improvements that have been made.

- Comparative sales in the area.

- Use class and extant permissions such as planning permission.

- Development plans that might change the value of the property in the future

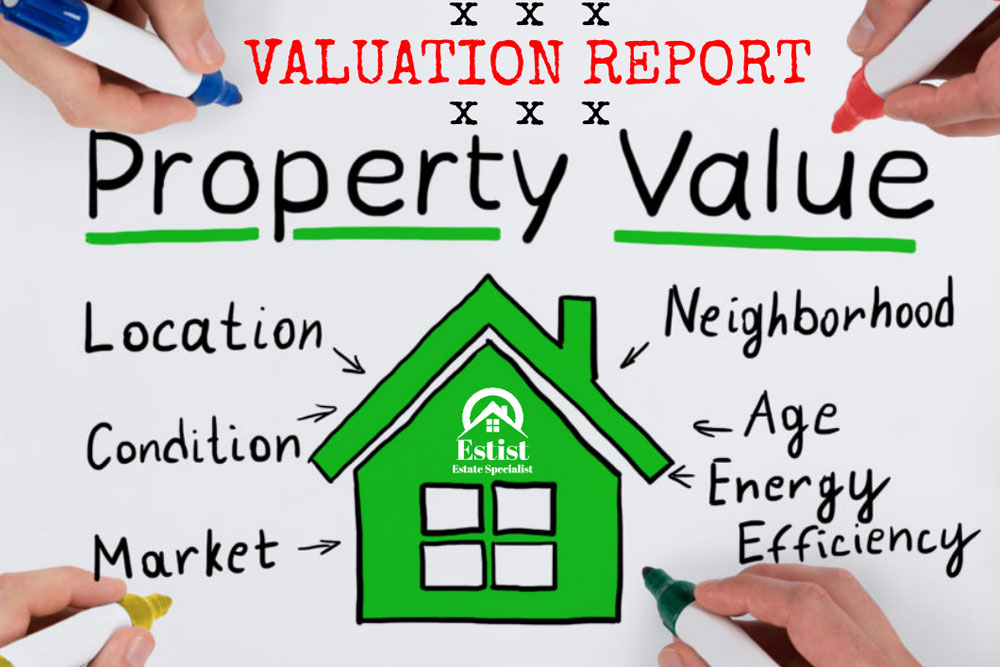

The valuation to be accurate because a property will be typically compared with other similar properties in the local area. Factors such as local infrastructure, reputation and attractiveness of the neighbourhood, market demand, and amenities will also be taken into consideration while valuating a property.

WHEN WOULD I NEED A PROPERTY VALUATION?

A property valuation offers benefits to both buyer and seller. In providing a clear indication of a property’s market value, it reduces a buyer’s risk of paying over the odds for a property; in offering a detailed analysis of a property’s weaknesses, it can help a seller decide which renovations to make to improve a property’s value. The common reason why people need a property valuation is because their mortgage lender requests for that.

The bank needs to be confident that it can recover any outstanding amount owned on the property.

HOW CAN I INCREASE MY HOUSE VALUE?

You can’t change your property’s location but you can make changes to the house. Think about a renovation or extending the floor area of the house: can you add a bathroom, bedroom or entertaining area.

Make sure the property is well presented: tidy up the garden, or remove any untidy trees or structures, make vehicle access easier. Give a mini makeover to the bathroom and kitchen.

Give your property a general tidy up, and be mindful of your property’s appeal, as this will greatly influence a buyer’s first impression. If your property looks neat and tidy from the street, it will be a benefit for the valuation.

If you are thinking of selling your home or property but not yet ready to commission a property valuation, you can get a free report containing the sold prices of properties similar to yours, to help you better understand the estimated value of your property.